Common Mistakes Made by New Investors

Doing your homework before you make the purchase

Interestingly, we are often hired when people are experiencing problems rather than as an initial tool for those considering investing in real estate. There are typically three types of clients who seek property management services.

1. **Long-Term Self-Managers:** These are individuals who have managed their own portfolios for years and have decided to turn over their properties to professional management.

2. **Mid-Term Investors:** These investors, after three to seven years, realize they don't want to be full-time property managers or investors and decide to hand over management responsibilities.

3. **Accidental Landlords and Small Investors:** This group includes people who have inherited a property or want to turn a starter home into an investment. They may also include those who intentionally bought properties with the goal of eventually turning them into investments.

Regardless of the situation, we are usually hired when problems arise, whether with the property, the tenant, or time management. Our role is to provide solutions.

Common Mistakes Made by Investors

Over the years, we have identified several common mistakes made by investors that can cost them time, energy, and money. Here are some key points:

1. Misjudging the Initial Purchase Price

- Overestimating the property’s current and future value.

- Not factoring in closing costs, escrow fees, and other upfront expenses.

- Being overly optimistic about the property’s potential.

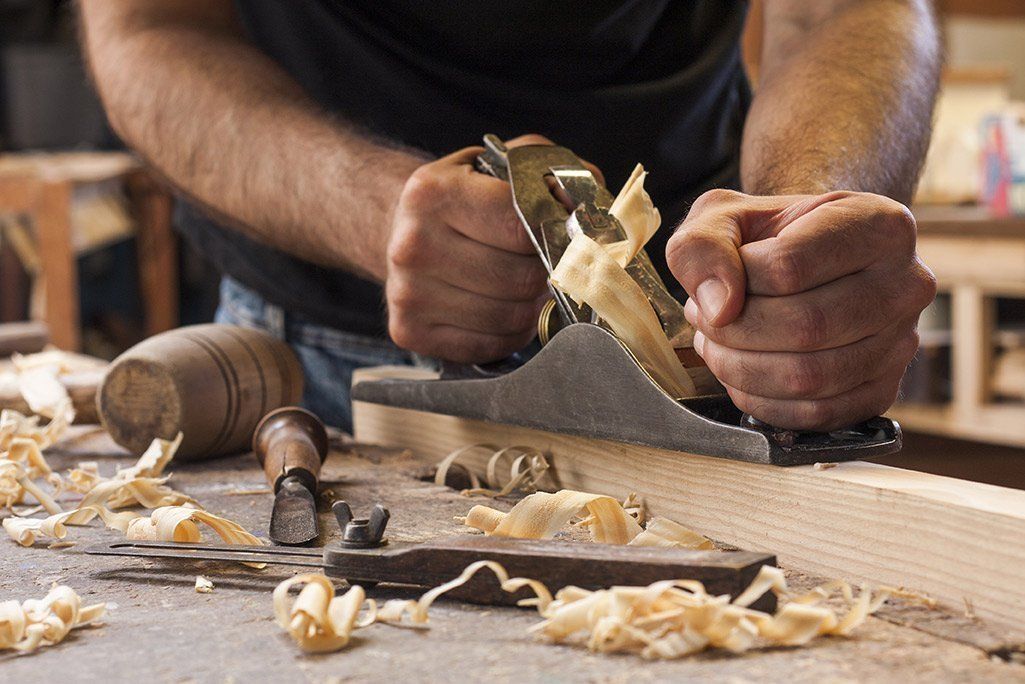

2. Underestimating Repair and Renovation Costs

- Relying on rough estimates without considering potential hidden damages like mold, pests, or structural issues.

- Expecting the lowest cost repairs and hiring the cheapest contractors often leads to multiple repairs and higher costs in the long run.

- It's better to aim for fair market prices and quality work.

3. Misestimating Value and Resale Potential

- Overestimating property value without thorough research and comparison.

- Ignoring market conditions and the impact of location, condition, and price on the property's resale value.

- Misjudging market demands and future trends.

4. Overlooking Holding Costs

- Forgetting about ongoing costs like insurance, utilities, and maintenance during the holding period.

- Not preparing for delays in permits or prolonged sale processes, which can significantly impact costs and timelines.

5. Financing Oversights

- Not shopping around for the best financing terms and being unaware of higher interest rates or hidden fees in loan agreements.

- Forgetting the terms and conditions of loans over time, leading to unexpected costs.

6. Ignoring Legal and Zoning Issues

- Overlooking local zoning laws or HOA restrictions, especially for short-term rentals.

- Investing in properties without understanding the legal landscape can lead to costly mistakes.

7. Emotional Decisions

- Becoming too personally attached to a property and making decisions based on emotions rather than financials and market demand.

- It's crucial to treat investments as business decisions and remain objective.

8. Not Understanding Ideal Tenants and Properties

- Investing in areas or properties without understanding the local culture, tenant expectations, and market dynamics.

- It’s essential to know your target tenant and invest in properties that align with your management style and goals.

9. Tenant Screening

- Thorough and compliant tenant screening is crucial, regardless of the property's value.

- Knowing your lease agreements and local laws can prevent future legal issues and ensure smooth property management.

10. Understanding Local Regulations

- Different areas have different regulations, fees, and inspection requirements.

- Investing in areas with investor-friendly regulations can save time and money.

In conclusion, understanding these common mistakes and being prepared can help investors make informed decisions and avoid costly errors. Whether you’re a new investor or an experienced one, considering these factors can enhance your investment strategy and lead to successful property management.